Increased product line complexity—and the desire to expand globally—prompted an initiative at Kirin Group to transform its FP&A. The organization chose to standardize activities with the Board Intelligent Planning Platform, and it successfully implemented a comprehensive financial planning and reporting solution across the enterprise. This enabled greater collaboration between the corporate HQ and the individual business companies that comprise the group. With greater visualization and scenario simulation capabilities, Kirin can empower its FP&A teams to make data-driven decisions and support the organization’s ambitious growth goals across multiple regions.

Board has played a crucial role in our process to digitally transform financial planning and reporting. Thanks to its scalability and flexibility, we were able to roll it out to all six main business companies—in only six months.

Yutaka Ogami

Deputy General Manager Of The Finance DepartmentKirin Group is known for globally recognized products including KIRIN ICHIBAN and Kirin Gogo-no-Kocha. The enterprise has diversified its business to include a wide range of products, including health foods, supplements, and pharmaceuticals. The expansive group has more than 30,500 employees working across a portfolio of more than 170 companies. With a goal to innovate across the spectrum from food to medicine, it leverages strengths such as bio-fermentation technology to expand its business domains. Actively pursuing global expansion, its beverage business operates in Australia, Southeast Asia, Europe, and North America.

Group Finance DX: The foundation for expansion and growth

Aligning shared values and long-term goals throughout the entire group was a significant challenge as Kirin aimed to grow. Understanding management plans and business company goals—and keeping them in aligned to corporate plans and goals—was a crucial step to ensure continued success in the organization.

To achieve this goal, Kirin Group established a new FP&A team in its holding company and across its main business companies. Its name: Group Finance DX. While its primary business function was management accounting, the corporate finance and planning team can collaborate closely with each business company to monitor management plans and optimize investments and resource allocation for the entire group. To ensure precision and accuracy, business plans with real-time data are shared with each team.

Kirin chooses Board to overcome the limitations of Excel management

Kirin looked to create an FP&A process across the entire enterprise to manage long-term business plans more effectively. Previously, plans were created in Excel by multiple business companies before being analyzed and assessed at the corporate. As Rei Ishikawa, Financial Strategy Department (FP&A), recalls:

Excel formats varied from one business company to another, making it challenging to compare and evaluate them side by side. Just aligning the formats was a laborious task.

Cumbersome and manual work must be minimized to allocate more time for higher level analysis and collaboration among the business companies. Adding to this challenge, conducting simulations in Excel was not an easy process. Ishikawa notes:

We needed to consider introducing a mechanism that allows for easy forecasting and visualization, like a dashboard.

After thorough consideration, Kirin selected Board Intelligent Planning to integrate all functions necessary for planning, from data input and budget creation to analysis, simulation, and report generation.

With each business company performing data input and budget creation on the same platform, there was no need for format standardization, resulting in significantly reduced manual work. Ishikawa notes:

Adding scenarios is relatively easy, making simulation much more straightforward compared to Excel. Board also allows for easy forecasting from various perspectives.

The 6-month challenge: Addressing individual requirements of six business companies

To implement Board, Kirin consulted with NTT Data, a company with a wealth of support experience. The experts recommended Board for all FP&A needs including easier collaboration between corporate headquarters and six major business companies. They planned for a development period of six months and requested NTT Data to complete the project with a minimal budget.

Yutaro Shimizu of NTT Data’s Corporate Consulting & Marketing Division, reflects on this challenge:

Even within Kirin Group, the six business companies have diverse business types, ranging from food and pharmaceuticals to health sciences. We had to clear up the paradoxical task of introducing Board quickly, and on a budget, while addressing a variety of requirements.

To overcome this challenge, NTT Data proposed designating one of the six business companies as the ‘model company’ to establish an effective template through. The five remaining business companies could then extend this template within their own processes. Shimizu explains:

Among the three main use cases for Board—Profit & Loss (P&L), Balance Sheet (BS) and Cash Flow (CF)—there aren’t significant differences in BS and CF, even when the business types are different. By using the template we developed with the ‘model company’, and customizing only the P&L part to meet the requirements of each business company, we could meet the requirement of a quick implementation at minimal cost.

One of the key benefits of Board was its ability to expand across departments. Ishikawa remarks:

Besides having all the functions necessary for planning and monitoring, it is one of the few platforms that could be expanded to deploy across the entire group.

Empowering a team of builders

To accelerate implementation, while keeping down costs, NTT Data trained an internal team at Kirin with specific skillsets to allow them to customize templates on their own. This initiative was a welcome development, as Ishikawa explains:

Of course, there is a cost-saving effect. But accumulating knowledge for development within the company also makes it easier to expand to new use cases in the future. We knew upskilling our team would be well worth the time and investment.

Leading the implementation, Ishikawa was joined by four staff members from the DX Promotion Office. Having five full-time team members dedicated to the project helped ensure implementation was successfully rolled out in such a short period of time.

In corporate DX projects, it is common to have employees work on a project alongside their regular duties,” states Shimizu from NTT Data. “However, dedicating full-time resources to this project increased the quality, reduced the need for revisions, and compressed the timeline and cost.

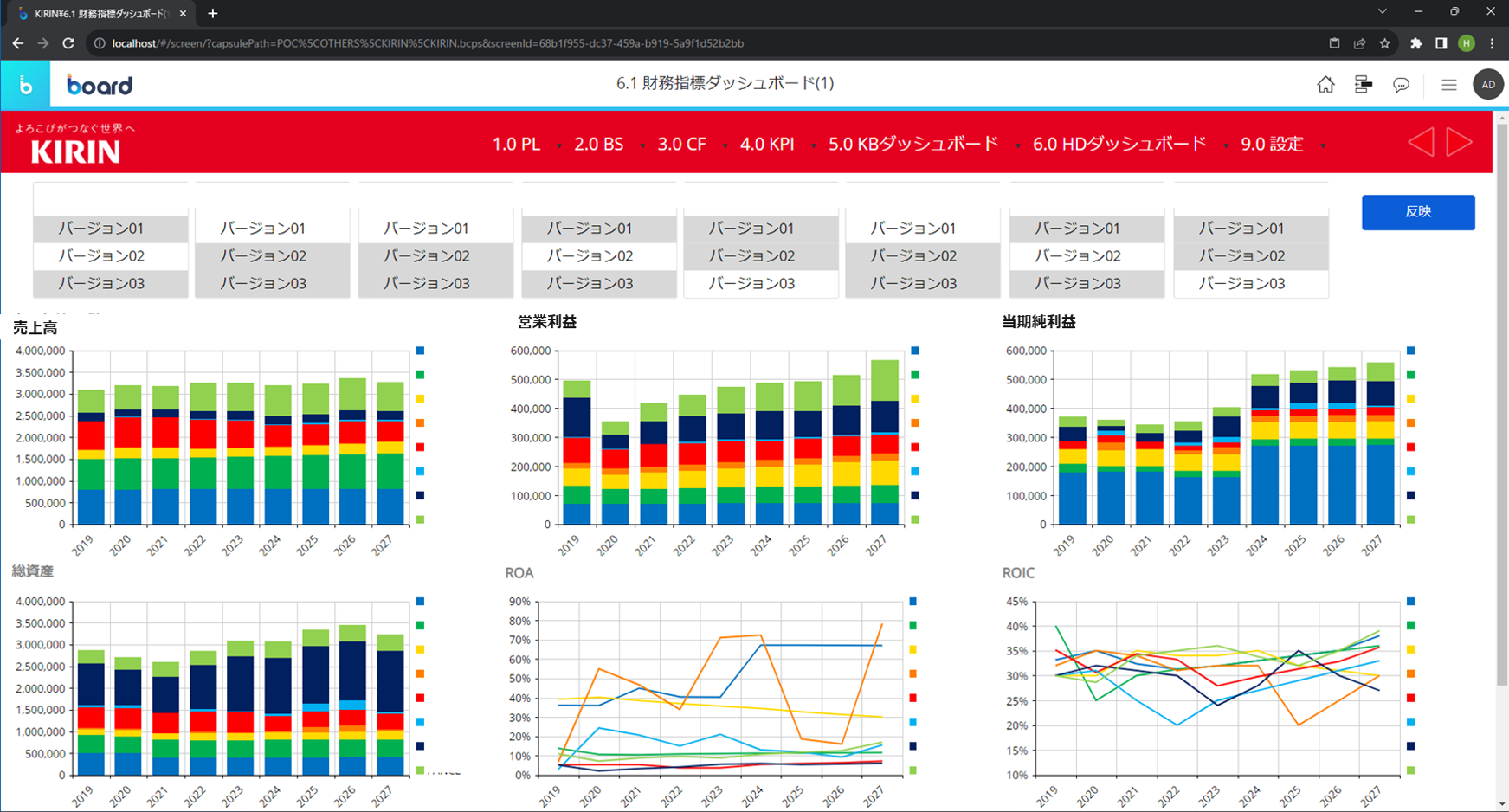

Kirin also launched a financial modeling dashboard powered by Board. This eliminated the need for the corporate FP&A team to organize Excel files sent by each individual business company. They could now share plans using the same dashboard—boosting collaboration among every business company. Yutaka Ogami, Deputy General Manager of the Finance Department at Kirin, concludes:

In the future, we aim to visualize the management plans of even more business companies and strengthen group-wide monitoring and governance. Our goal is for FP&A to contribute to the company’s growth.

Kirin’s financial modeling dashboard on Board presents clear and easy-to-understand visualizations of various simulations, including revenue forecasts for different scenarios.