Martin Horrocks

VP Global Commercial Excellence, BASFThe goal is not perfection; the goal is to do it better than I can do it as a human.

This website will offer limited functionality in this browser. We only support the recent versions of major browsers like Chrome, Firefox, Safari, and Edge.

We are only a few months into 2025—but this year is already shaping up to be a real turning point for enterprises. Considering events such as sweeping tariff proposals or the sudden reduction of the US federal workforce, your Monday-morning market outlook might look strikingly different by week’s end. And as economic uncertainty and potential supply chain disruptions come onto the radar, organizations are now challenged to rethink how they plan for the future of their business—not only to survive the next disruption, but to thrive.

In this environment, proactive scenario planning is more critical than ever. Companies need clear answers to pressing questions: ‘What is the course of action if tariffs are enacted at 10%? Or 20%? How will that impact supply chains, pricing strategies, and overall financial resilience?’ The reality is that planning for the future isn’t just about reacting to change—it’s about anticipating and preparing for what comes next.

For answers and insights on these challenges, Board spoke with a group of experts—including an economist, a customer, and implementation partners. Collectively, their insights underscored three overarching macro trends:

Here’s what the experts see coming later this year and how businesses can stay ahead…

No surprise here. AI is already enriching how organizations strategize, analyze, and execute their plans. Today, however, we are starting to see a significant shift from experimentation to execution as businesses look to make AI a tangible tool—embedding it into financial planning, forecasting, and scenario modeling.

The goal is not perfection; the goal is to do it better than I can do it as a human.

Early adopters are poised to gain new insights into market trends and customer behaviors. As data complexity continues to grow, integrating AI into planning processes not only enhances agility but enables leaders to make more confident decisions around resource allocation and forecasting.

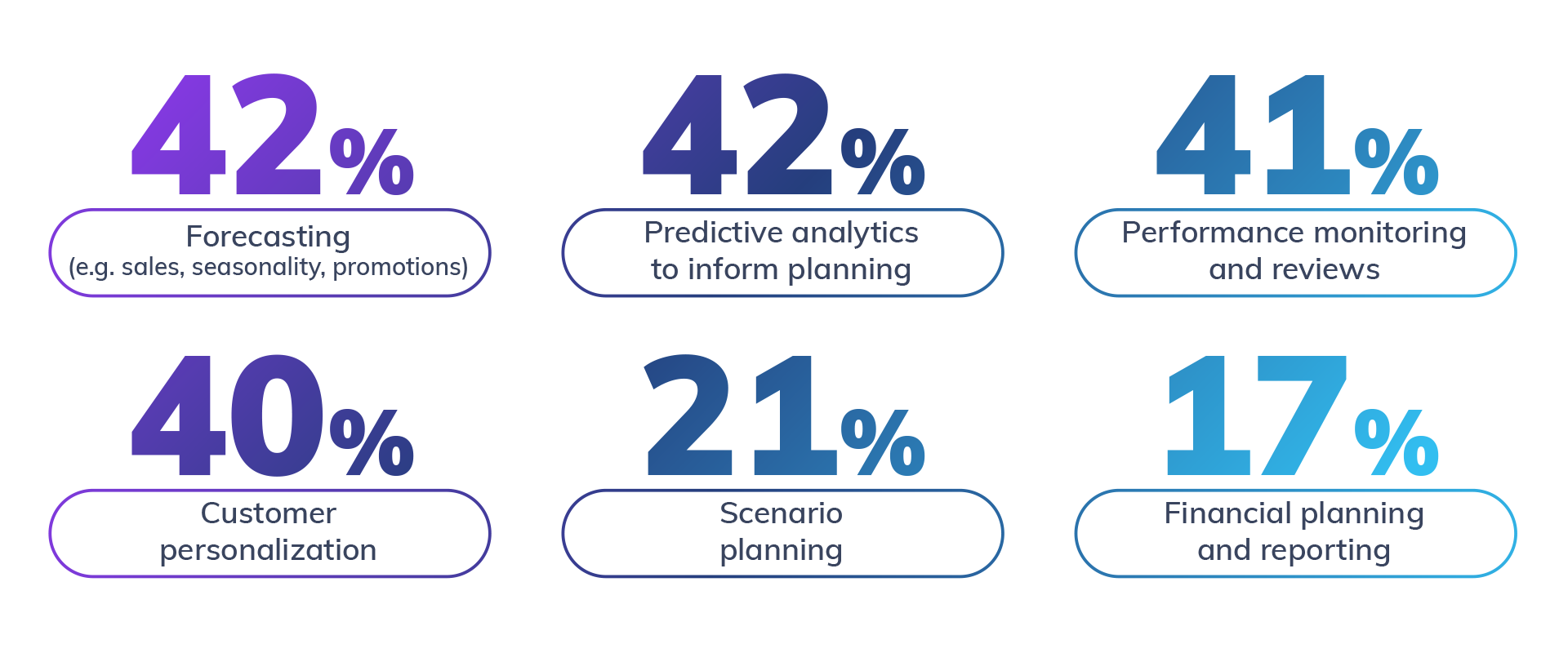

A year ago, Board surveyed 1,500 experts to benchmark AI adoption in enterprise planning. The findings? Organizations were investing in AI across a range of use cases:

12 months later, the conversation has shifted from aspiration to action. And this year, experts are weighing in directly—here’s where they see AI making the biggest impact in 2025.

SUPERCHARGED WORKFLOWS ARE COMING ONLINE

In 2024, companies were still figuring out how to use generative AI (GenAI). Many were focused on security, ethics, and initial test cases.

“2024 was a year for people to adjust to the idea of GenAI,” shares Charles Wilson of Wipro. “In 2025, organizations will fully embrace GenAI, prioritizing solutions that seamlessly integrate its capabilities to drive efficiency, innovation, and smarter decision-making.”

The 6 most expensive words for managing a finance organization are "We've always done it this way."

Wilson notes that the ownership of enterprise performance management (EPM) tools has historically sat within the office of the CFO. But given the pace of change—and the need for real-time financial and operational data—every department in an enterprise should expect to benefit from AI-powered EPM and planning solutions in the near term.

“GenAI solutions need to be embedded into daily workflows—not siloed with data scientists,” says Wilson. “AI exists to handle the overwhelming data and complexity that surpass human capacity. It must be seamlessly integrated into everyday operations, supporting every decision we make.”

Glen Wedel of EY agrees—predicting a rise in real-world AI experimentation:

“GenAI will start emerging within FP&A processes as leading organizations experiment with its potential to improve productivity and generate real-time insights. Given the pace at which AI is advancing in capability, I expect leading organizations will be strongly utilizing GenAI throughout 2025.”

AI USE CASES: GOING BEYOND AUTOMATION

The early adopters are now going beyond automation and leveraging AI for predictive analytics, scenario planning, and strategic decision support.

“Businesses higher up the planning maturity scale will augment planning with AI tools to refine forecasting, detect anomalies, and automate manual processes. This frees up financial teams for more strategic initiatives,” shares Wedel.

Even simple AI applications can drive massive efficiency gains.

“The most important trend for enterprise planning isn’t flashy AI—it’s the ‘brain-dead simple, you-don’t-even-have-to-think-about-it stuff’ that AI can do, like flagging errors and empowering teams through natural language processing,” notes Robert Kugel of ISG.

Where do the experts see the most advanced organizations farther along on the adoption curve taking AI in 2025? Wedel notes that as AI models improve, they will increasingly act as autonomous agents, making recommendations—or even decisions—on behalf of employees. He adds:

Ultimately, capabilities stemming from agentic AI will be able to crunch vast amounts of data to improve efficiencies, reduce operational costs given real-time indicators, and mitigate potential risks before they become problematic. But as Kugel points out:

“It’s not about features and functions; it’s about customer success. The bottom line? 2025 is the year of make it real.”

MOVE FAST—WITH TRANSPARENCY

Despite AI’s obvious potential, there’s one challenge organizations cannot ignore: trust.

“AI helps bring order to complexity, but it can’t operate as a black box,” says Wilson. “We need transparency—an understanding of where insights come from, how the reasoning works, and how we can verify the results.”

“The other thing is being honest. The biggest mistake is rushing into AI before you have the data suitable to support it,” warns Martin Horrocks of BASF. “If you build a model too soon, you risk undermining confidence in the whole initiative and could end up shooting yourself in the foot.”

THE TAKEAWAY

2025 is the year AI moves beyond the hype. But success depends on transparent, explainable AI that teams trust—and use. As Wilson astutely observes:

“We’re experiencing a fundamental shift in mindset. Instead of simply generating reports for the CEO, we’re now leveraging AI to conduct broad analyses that drive more informed decision-making. This represents a new approach to problem-solving—one that requires a higher level of maturity and trust than ever before.”

Forward-looking organizations are prioritizing advanced scenario planning capabilities—and 2025 is poised to intensify this shift. Heightened uncertainty surrounding external (uncontrollable) factors such as government policies or potential new tariffs affecting global trade and supply chains underscore the need for greater agility.

Principal Economist Natalie Gallagher notes:

“With the US Department of Health and Human Services urging food companies and CPGs to address artificial dyes, companies need to consider how to adapt quickly. This could involve being prepared to secure new suppliers, reformulate products, and evaluate logistics. In a dynamic and uncertain market, businesses benefit from continuously modeling various scenarios to manage pricing and inventory effectively.”

2025 is about fundamentally elevating the sophistication of your organization’s planning processes. That means integrating AI, advanced analytics, and machine learning directly into your planning processes.

Having the capability to quickly model, plan, and act with confidence will likely amplify the divide. Organizations that embrace external data and scenario planning will pull ahead—while those relying solely on internal data risk falling behind,

“Predictive analytics are practically useless if they are only based on internal data,” emphasizes Kugel. “If you don’t factor in external market signals that tell you what’s going on in the economy at large you’re not seeing the full picture. Simply relying on internal data is just fancy extrapolation.”

WHY SCENARIO PLANNING MATTERS MORE THAN EVER

Economic uncertainty is making agility the defining competitive advantage. Businesses need to model multiple outcomes and adjust strategies accordingly.

“What happens if tariffs rise to 10%? Or 20%? How does that impact your supply chain and pricing?” asks Natalie Gallagher, Board. “Having the answers ahead of time gives you the ability to pivot operational strategies without hesitation.”

Incorporating external variables into scenario modeling is essential for accurately predicting business performance. Factors such as market and industry trends, economic indicators, and competitive dynamics provide a radically broader context that internal data alone can’t capture. Wedel adds:

“Organizations that focus on their internal structured data first are often missing a huge opportunity. In our experience, the biggest gains in reducing forecast error come when external and/or unstructured data is added to the mix. External data is often available pre-cleansed. Sure, it’s important to have quality internal data, but it should not be the showstopper.”

By integrating both sides of the equation, businesses can create more realistic and agile forecasts, better anticipate disruptions, and make confident decisions to stay ahead in a rapidly changing environment. And AI can help make sense of the vast data sets, as Gallagher notes:

“Instead of manually sifting through millions of data points, AI can surface the most relevant external factors and generate theoretical forecasts.”

When I started in finance, I spent most my time writing Excel formulas, cleaning data, and figuring out how to have meaningful conversations. With GenAI, I can now take a picture of a spreadsheet or an unstructured PDF, drop it into a tool, and run an analysis. This changes everything!

TAMING THE PRODUCTION PENDULUM

This is the year that predictive forecasting models will become even more prevalent as companies navigate the complexities of supply and demand with greater accuracy. Yet, forecasting is an imperfect science by nature—and humans rarely, if ever, get it 100% right.

Instead, many organizations swing between under-forecasting one year (leading to lost sales, dissatisfied customers, and increased churn) and over-forecasting the next (tying up available capital in excess inventory and triggering concerns of inefficiency from the board and investors). A vicious (and costly) cycle!

“Striking the right balance is part art and part science,” explains Martin Horrocks. “Using the models we’ve built helps reduce these pendulum swings and makes forecasting more accurate across cycles.”

AI can help stabilize this. Horrocks continues:

“AI takes human emotion out of the equation and helps us gain new perspectives. We’ll still see forecasting swings, but AI can reduce their amplitude on these patterns—so companies face fewer penalties in lost sales or excess inventory.”

BEWARE THE BIAS OF PERSONAL DISBELIF

Forecasting economic trends is never simple, but the greatest challenge might not be coming from the data—it could be overcoming the bias of objectivity.

“As humans, we get wrapped up in our personal perspectives,” shares Gallagher. “We say things like ‘that can’t be right’ as we miss important details or discount ideas.”

Success hinges on having the right infrastructure for real-time data integration, a single source of truth, and continuously updated insights. Done right, these practices ensure accurate, explainable, and defensible forecasts. Gallagher adds:

“If an organization uses data to challenge its perspective—or even rely on the data to inform subjective analysis—it’s going to achieve better results, even if that’s just in the form of increased explainability.”

THE TAKEAWAY

The forecasting leaders of 2025 will be those that integrate external data, run continuous scenario modeling, and use AI to cut through complexity. Horrocks summarizes:

“We tell ourselves agriculture is difficult to forecast because of weather and commodity prices. But I’ve seen the fantastic work we’ve done looking at statistical forecast modeling and using machine learning to take the emotion out of those decisions. People are skeptical about whether it could work, but I think for the first time we have provable models—maybe not for the entirety of our portfolio—but definitely for large portions of it.”

With a full view of customer preferences and behaviors, businesses can tailor their products and services to meet customer needs better, optimize inventory, and reduce waste. EPM tools help simulate different market scenarios, ensuring companies are prepared for various outcomes and can make informed decisions.

Finance, operations, and supply chain leaders are under serious pressure to deliver faster insights, manage complexity, and quickly pivot in a landscape where change is constant. But success isn’t necessarily about having the best tools and technology; it’s about bringing people together.

Just as AI and automation reshape enterprise planning, organizations must bring teams along for the journey—aligning to a shared vision, promoting continuous collaboration, and empowering people to do what they do best.

“If you don’t have buy-in, you can have the best forecast in the world—and no one will use it,” warns Gallagher.

‘SHOW, DON’T TELL’ BUILDS TRUST IN AI INITIATIVES

Getting people to trust AI-generated forecasts takes time. Horrocks recommends letting the work speak for itself to successfully bring colleagues along in the journey:

“At first, no one trusted the AI-generated model in our supply chain meetings. But over time, as the AI model kept outperforming manual forecasts, people started paying attention. Sometimes, it’s better to just let the results speak for themselves.”

FOSTERING CROSS-DEPARTMENT, CONTINUOUS COLLABORATION

AI is breaking down traditional silos, making planning more of a company-wide process rather than just a key function of the finance department.

“Breaking down organizational silos and fostering enterprise-wide collaboration has long been a challenge—largely due to the limitations of tools like Excel and email,” says Wilson. He adds:

“Now, planning is no longer just a financial exercise; it’s about seeing the bigger picture. HR, for example, can seamlessly collaborate with finance while also leveraging the same tools to gain critical insights—such as understanding workforce skills or measuring employee satisfaction. And this extends across all departments, enabling a more connected and strategic approach to decision-making.”

THE TAKEAWAY

The most advanced planning systems won’t succeed without human adoption. And 2025 places a premium on the need for organizations to actively build trust, foster collaboration, and promote a culture of continuous learning. This will allow their teams to focus on higher value work, and transform their planning processes into continuous, predictive planning, so they can respond to operational disruptions and regulatory shifts quickly—even before they impact the bottom line.

As Robert Kugel points out—bringing people along from a change management perspective starts at the top:

“In the midst of increased global turmoil or evolving regulatory challenges, we need to ask ourselves how do I get my staff to adapt to new technology? And I would say tone at the top is essential to building trust across teams and departments—that we’re all in this together—and we’re going to find new ways of accomplishing great results.”

We can see that 2025 will be a defining year for enterprise planning. Those who embrace AI, refine forecasting, and foster collaboration position themselves to finish the year in a better spot than their competitors. Those that don’t risk getting left behind in an environment that continues to perpetually evolve.

AI is moving from hype to reality, scenario planning is no longer a luxury, and success depends on people embracing change as much as (if not more than) the technology itself. But these shifts are not just about adopting new tools or solutions; they are core to how businesses now need to think, plan, and act. Tomorrow’s leaders will be:

At Board, we’ve seen firsthand how businesses that plan beyond conventional methods are driving better decisions, stronger performance, and long-term resilience. There’s a new chapter in enterprise planning that not only looks to better predict the future—it looks to reshape it.

Natalie Gallagher | Principal Economist, Board

Natalie Gallagher leads macroeconomic research efforts and provides in-depth analysis and forecasting to support strategic decision-making for Board’s customers. Through specialized industry research in areas like Retail, Food and Beverage, and Manufacturing, she leads a team of economists in uncovering key trends and insights that help leading companies navigate complex market dynamics.

Martin Horrocks | Vice President Global Commercial Excellence, BASF

Martin Horrocks is a seasoned business executive with deep expertise in the chemical, coatings, polymer, and agricultural markets. With extensive leadership experience across complex multinational organizations, he has successfully managed full P&L responsibilities while driving operational and strategic growth. His career spans leadership roles in both specialty markets and more commoditized segments, demonstrating his versatility in navigating diverse business landscapes.

Robert Kugel | Executive Director, Information Services Group

Robert Kugel leads and manages the business software research and advisory team focusing on the intersection of information technology and applications across front and back-office areas of enterprises. He leads the Office of Finance practice and the AI for Business efforts and is a book author and thought leader on integrated business planning (IBP). Before ISG and two decades at Ventana Research, he was an equity research analyst at several firms including Credit Suisse, Morgan Stanley, and Drexel Burnham, and a consultant with McKinsey and Company.

Charles Wilson | Thought Leader, Analytics, AI, EPM at Wipro Limited

Charles Wilson is a seasoned executive with 25 years of expertise in business process analysis, risk assessment, and enterprise-wide solution implementation. Specializing in financial modeling and operations, he has a proven track record of driving efficiency, optimizing performance, and executing strategic growth initiatives. His extensive industry experience spans Banking, Insurance, Capital Markets, Manufacturing, Distribution, Retail, Consumer Electronics, Healthcare, Life Sciences, CPG, Grocery/Food, and Higher Education—positioning him as a versatile leader adept at delivering results across diverse sectors.

Glen Wedel | EPM Solution Leader, EY

Glen Wedel is a results-driven leader with over 20 years of experience in transforming businesses and improving performance. Recognized for his expertise in finance, analytics, and operational strategy, he has been a sought-after speaker at conferences across North America, covering topics such as the evolution of the finance function, outsourcing, shared services, and driver-based planning. His insights have also been featured in leading business publications. A builder at heart, Glen has played a key role in growing consulting practices at Ernst & Young, KPMG, and Bluespark, contributing to business development, marketing, recruitment, project execution, and overall practice management.