Budgeting of clinical trials

The implementation of clinical trials is associated with immense costs for the performing company as …

Both during and after times of crisis, such as COVID 19, companies may find several reasons for having a clear and transparent picture of their liquidity situation. Among these reasons may be economically turbulent times requiring increased attention on liquidity, increased customer default risks as well as a high impact of currency fluctuations on company success.

Our application creates transparency through a rolling 13-week cash and liquidity forecast for single entities as well as whole groups. Expected cash movements are recorded decentrally by originating business units supported by modern technological features for efficient processing. The approach considers major positions with an impact on liquidity such as cash-ins from receivables as well as cash-outs from purchasing activities and operating costs, investments and financing. The result is a clear picture of the short-term liquidity situation, that allows to identify required measures at an early stage and to manage liquidity proactively.

A solution by KPMG Germany

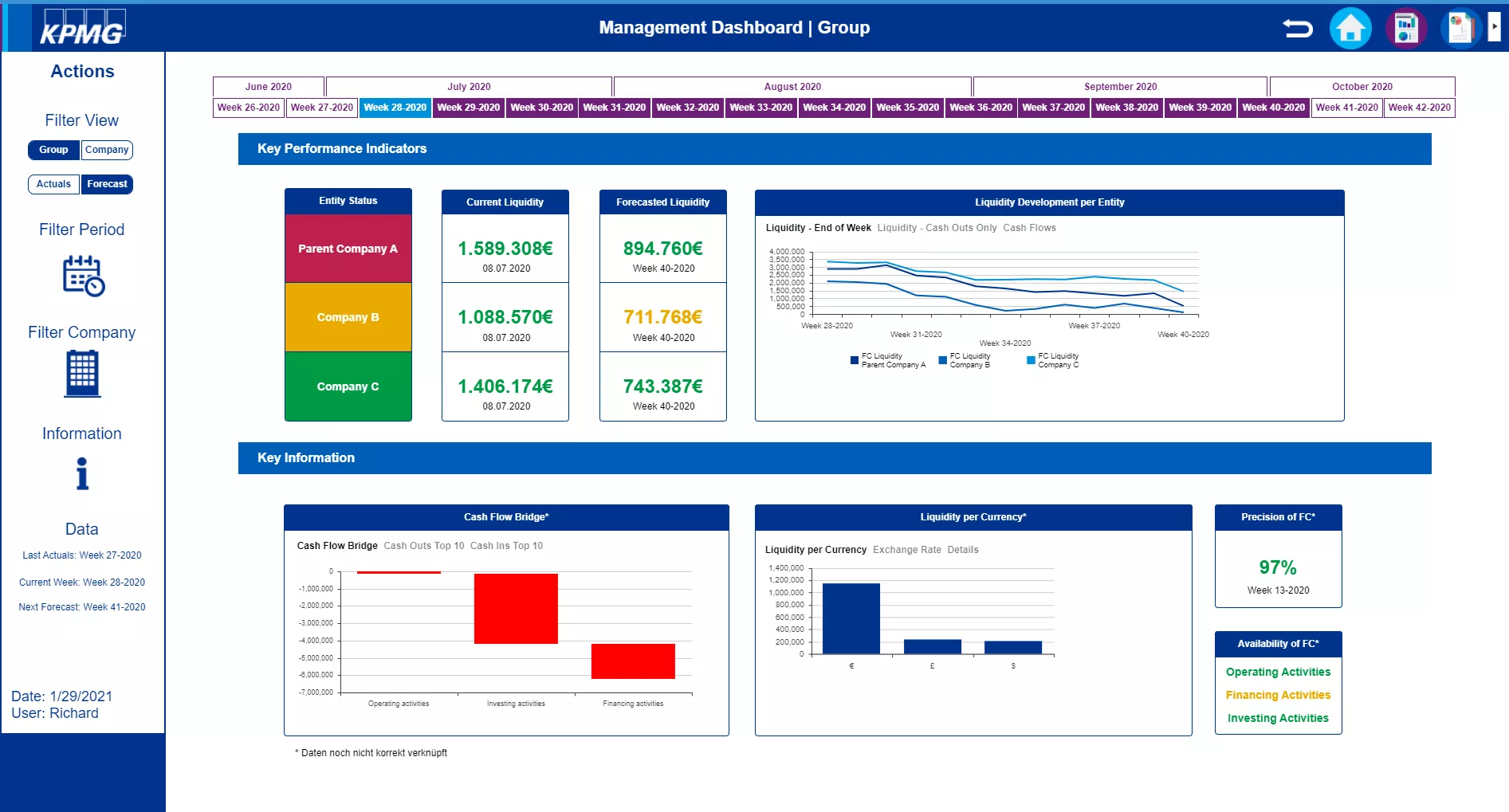

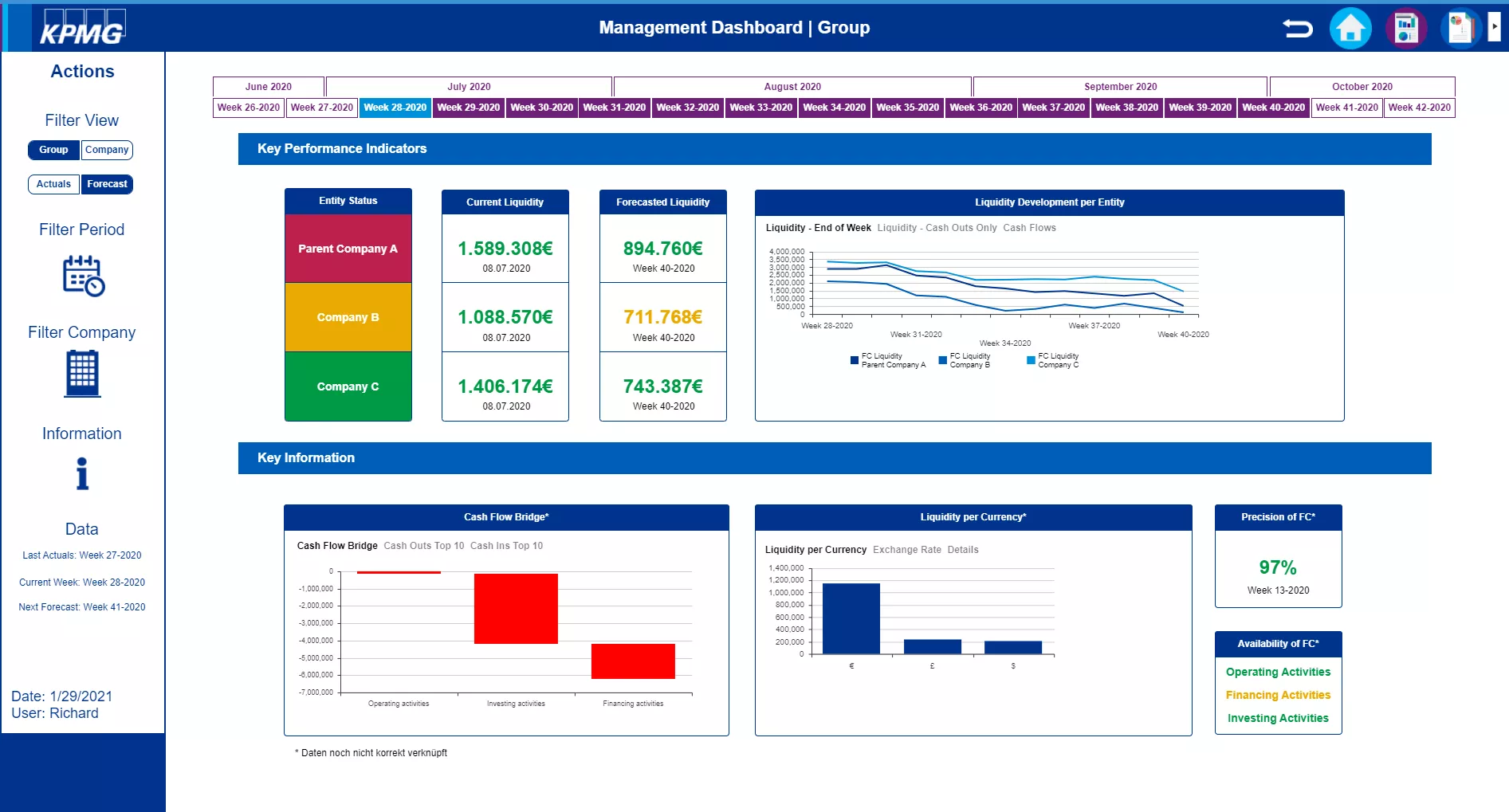

The application is composed by intuitive, high-level dashboards accompanied by detailed cash and liquidity standard reports as well as a data entry section for capturing the required database.

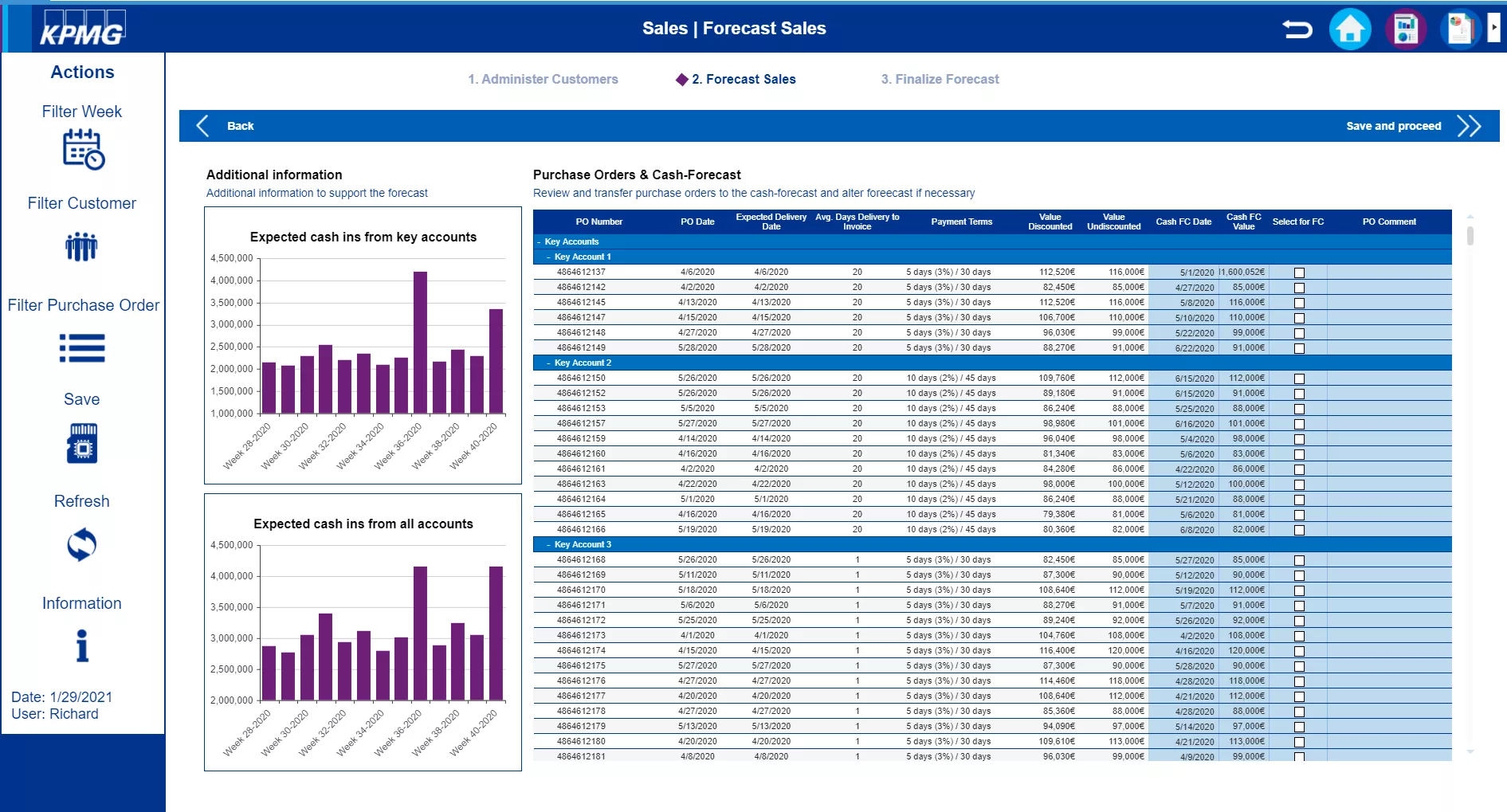

Efforts to forecast major cash flow positions like customer receipts are minimized through the effective use of technology promoting automation and process efficiency. An example is the possibility to import and alter customer purchase orders and volumes from operating systems as a forecast basis. Different approaches for capturing expected cash-ins distinguishing substantial key accounts from other accounts can be applied to balance forecast effort and materiality. Adding information like customer payment terms and expected default risks further enhance the depth of forecasts and analysis.

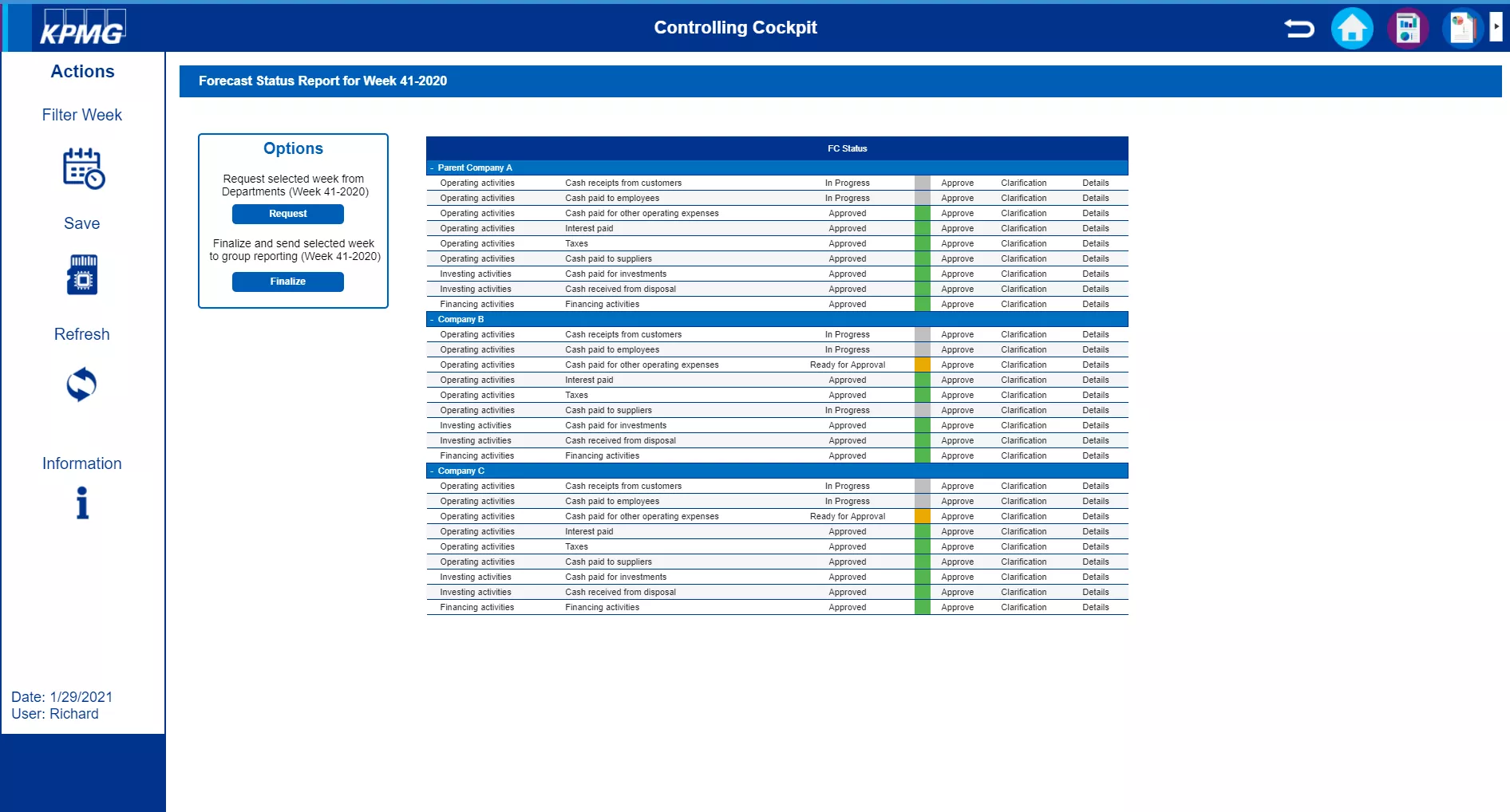

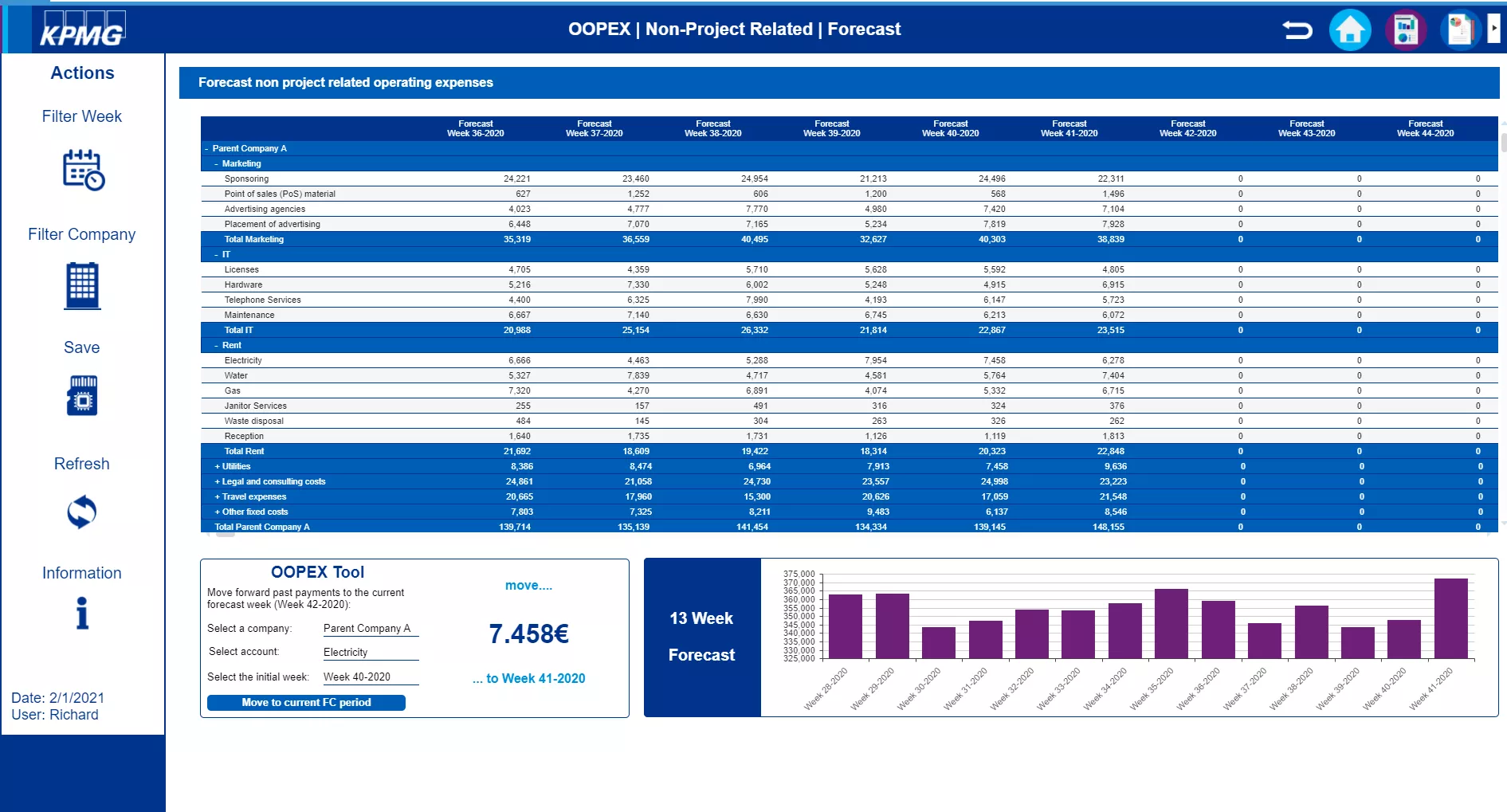

Cyclically recurring cash-outs such as salaries and regular operating expense positions only need to be planned once as they can be rolled forward into the next forecasting period. Additionally, forecast process efficiency and transparency are supported through technological features like individual workflows and approval processes with clear responsibilities.

A set of standard reports covers major liquidity information needs with cash flow statements, time series analysis, covenants analysis and currency development reports. The possibility of self-service reporting allows to cover additional information requirements.

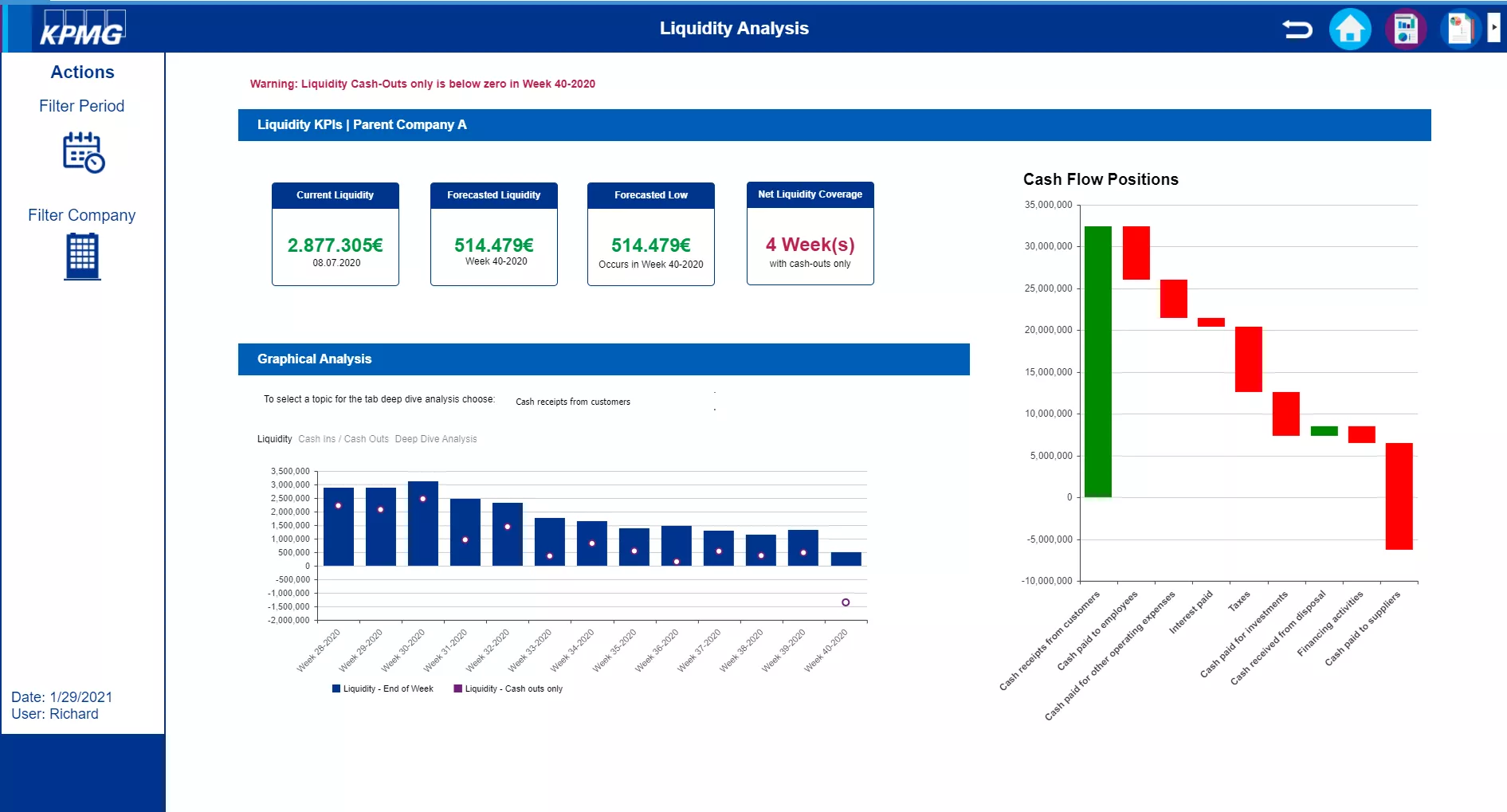

Intuitive dashboards help decision-makers to gain quick access to a group’s or an entity’s cash and liquidity situation through selected KPIs. Among these are the current liquidity, expected liquidity at the end of a 13-week forecast period, the spread between a period’s cash-ins and cash-outs as well as net liquidity coverage in case of total cash-in default.

Besides comprehensive standard functionalities the application can be configured to reflect an organization’s individual circumstances and information needs.

A management dashboard on group and company level provides decision-makers with a quick and intuitive overview of the current liquidity situation including the actual and the forecasted liquidity

The administration allows to efficiently track the forecasting process, review conducted forecasts and communicate with the responsible forecasters of the respective business unit

The sales forecast allows an efficient forecasting of expected cash-ins from customers by taking into account customer default risks and individual payment terms

The forecast for other operating expenses helps to minimize forecast efforts with the option of rolling forward reoccurring cash-outs

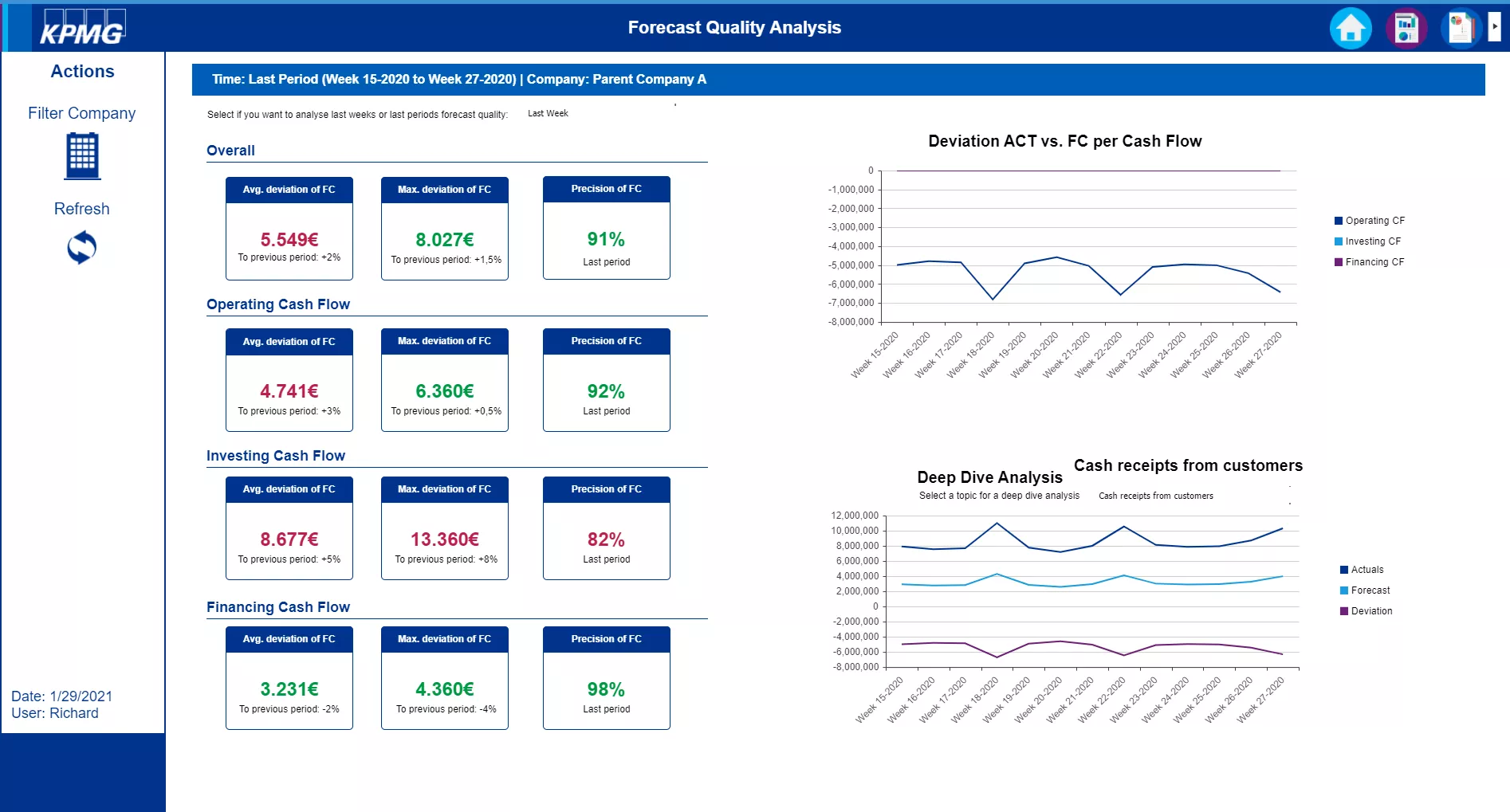

The forecast quality report allows the user to precisely track the deviation between actual and forecasted liquidity for continuous improvement

The liquidity analysis offers a comprehensive look at all cash-ins and cash-outs influencing the company’s liquidity and helps to identify potential shortages and take measures proactively

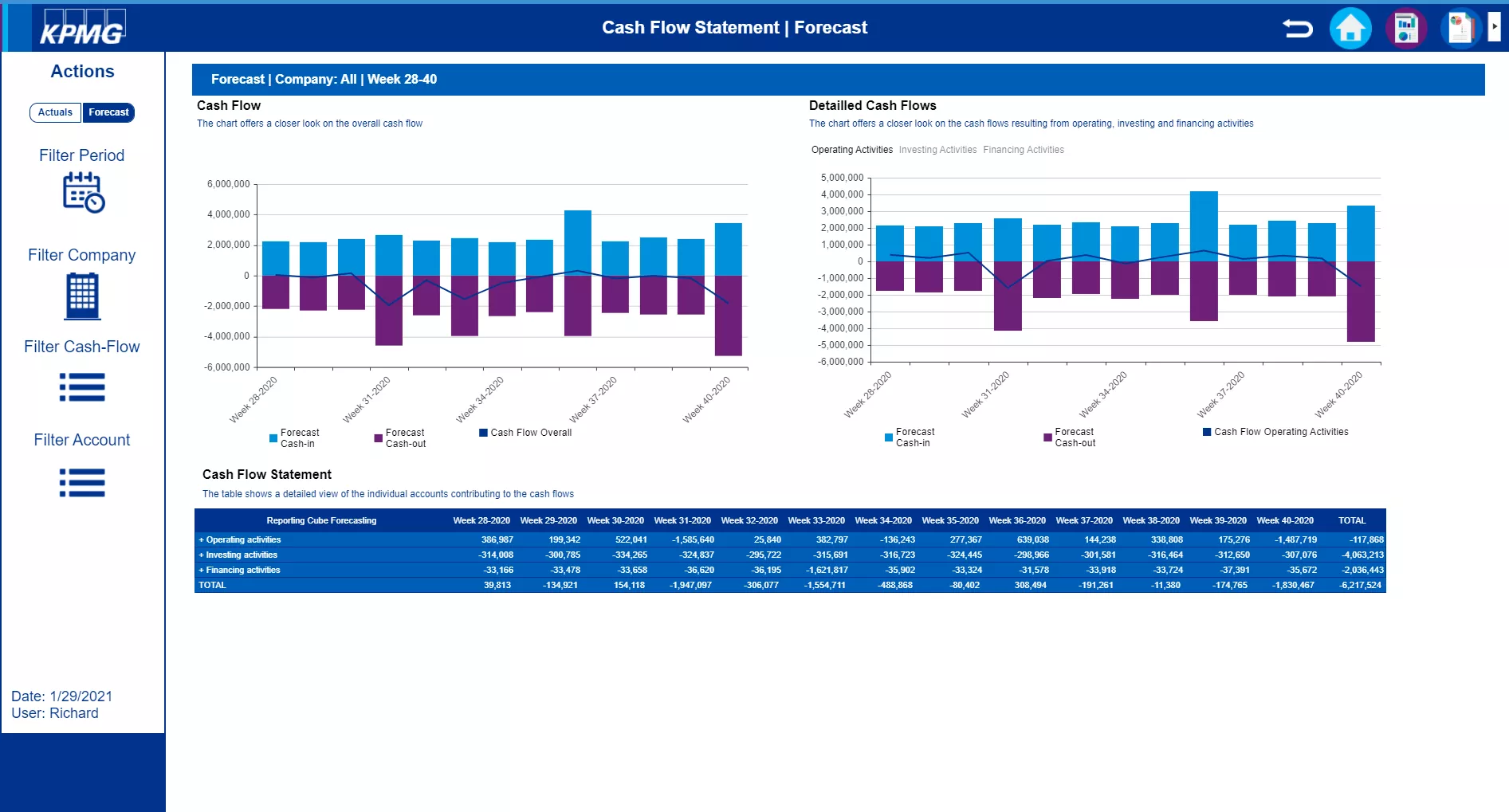

The cash flow statement gives an overview of the projected changes in cash resulting from operating, investing and financing activities accompanied by graphical displays of expected cash-ins and cash-outs.

The implementation of clinical trials is associated with immense costs for the performing company as …

The uncertainty of today’s fast-paced world is requiring the planning process to evolve to an …

Successful growth in companies is often linked to a multitude of initiatives that present project …

The topic of Environmental, Social & Governance (ESG) is becoming increasingly important for …