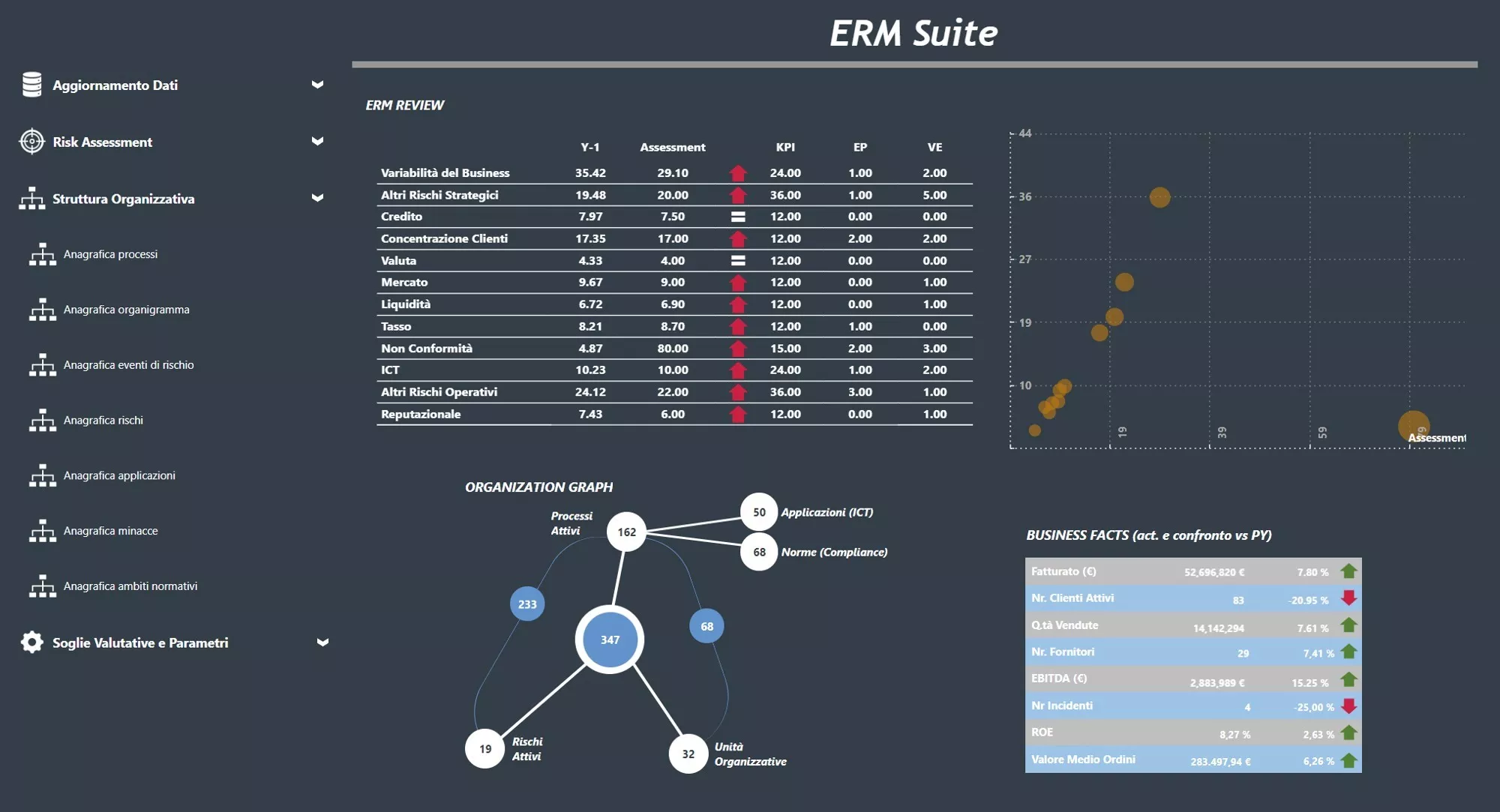

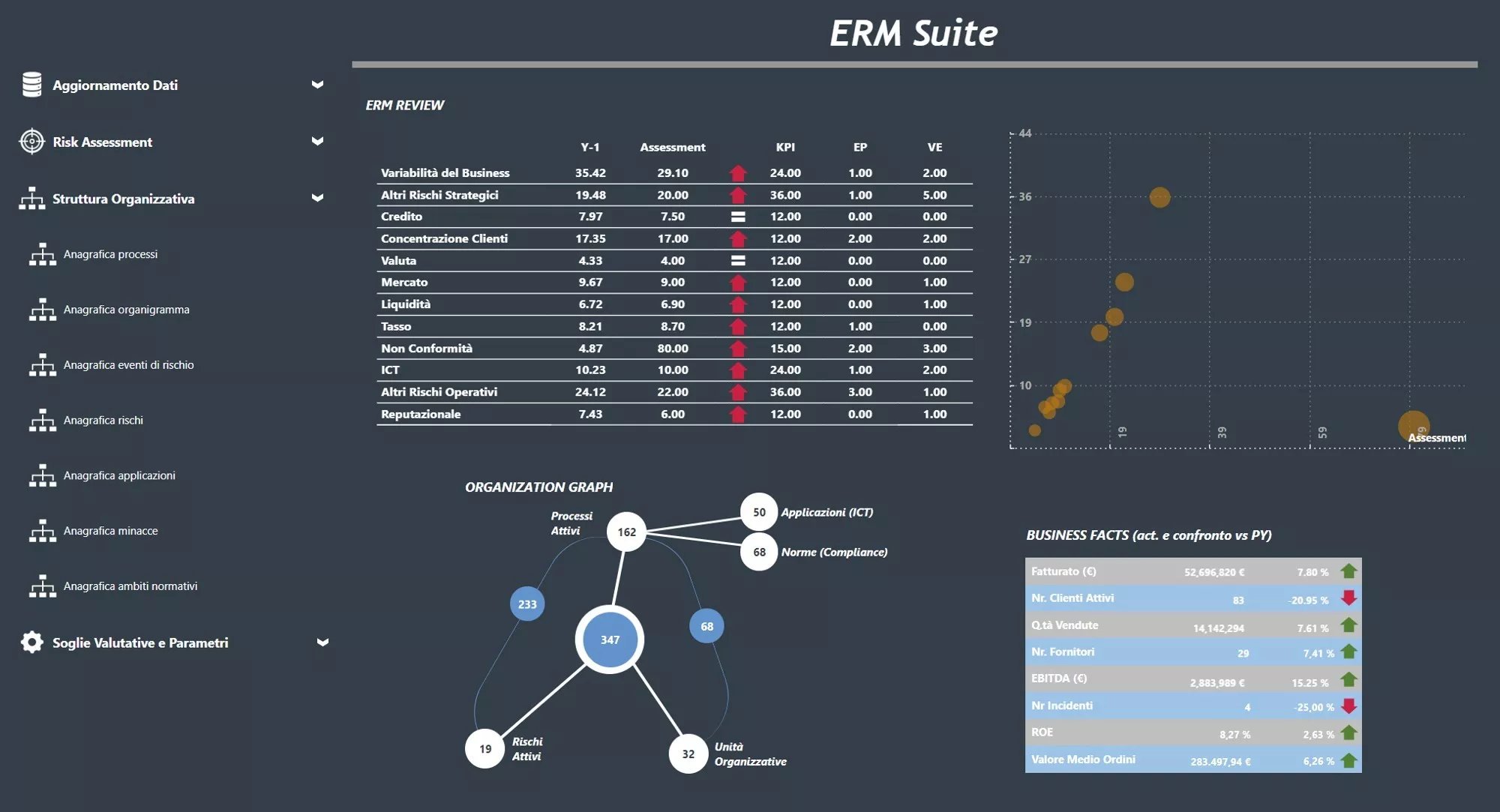

OIDA Enterprise Risk Management Suite

A unique application supporting the end-to-end Enterprise Risk Management process (Identification, Measurement, Monitoring, and Reporting) through collaborative operating workflows. It helps organizations to apply quantitative and qualitative methodological approaches, exploiting risk-specific best practices (Strategic Risk, Business Risk, Compliance Risk, Credit Risk, Operative Risk, ICT Risk, Environmental Risk, Reputational Risk, Sustainability Risk, etc.). Starting from a well-defined core, the application supports customization by industry or even by single company and leverages existing sub-models in an integrated approach.

A solution by OIDA

The OIDA Enterprise Risk Management Suite is intended to guide and simplify the process of:

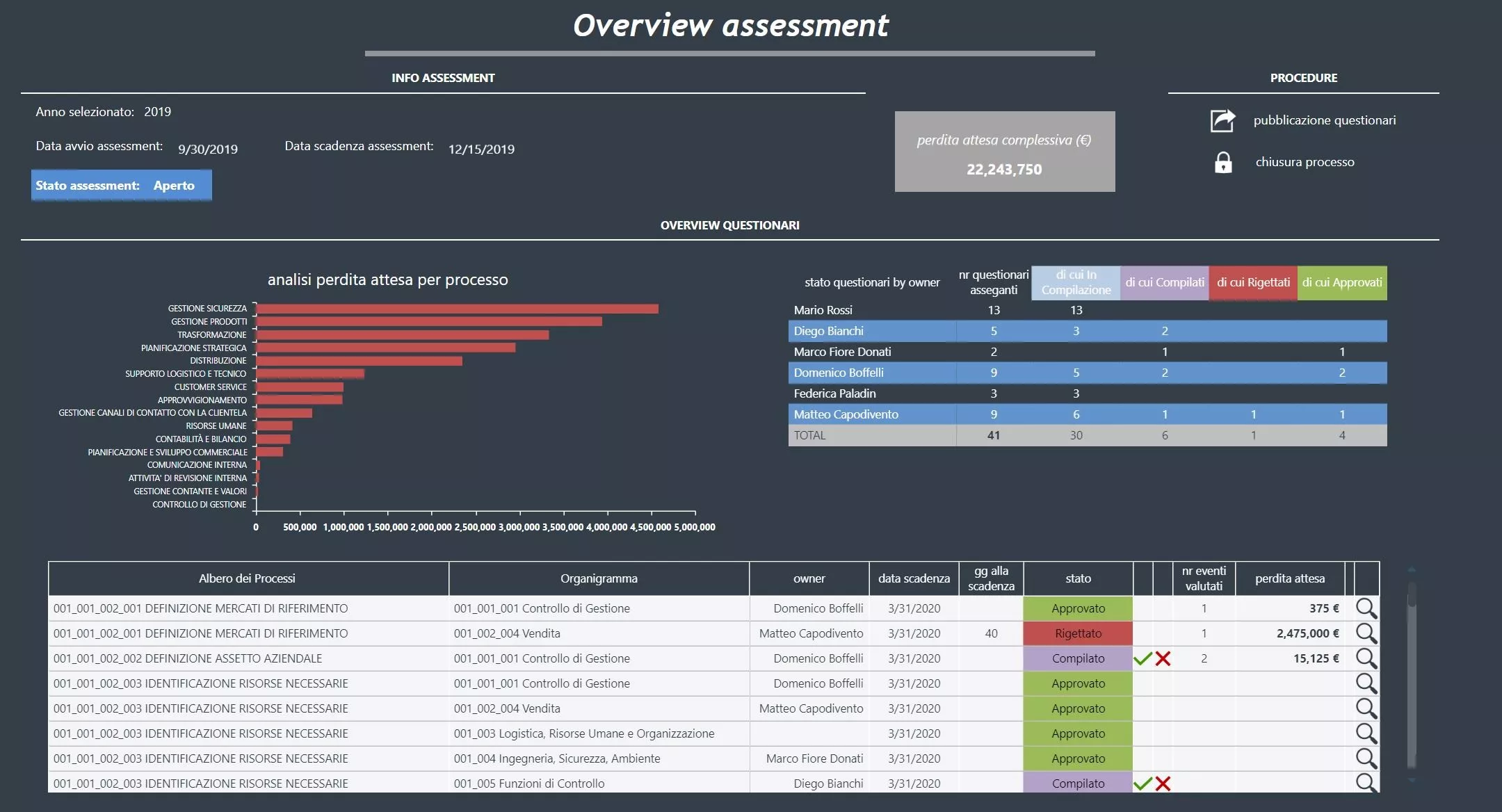

- Risk assessment at any level, managing collaborative workflows by activity, risk, and/or organizational unit

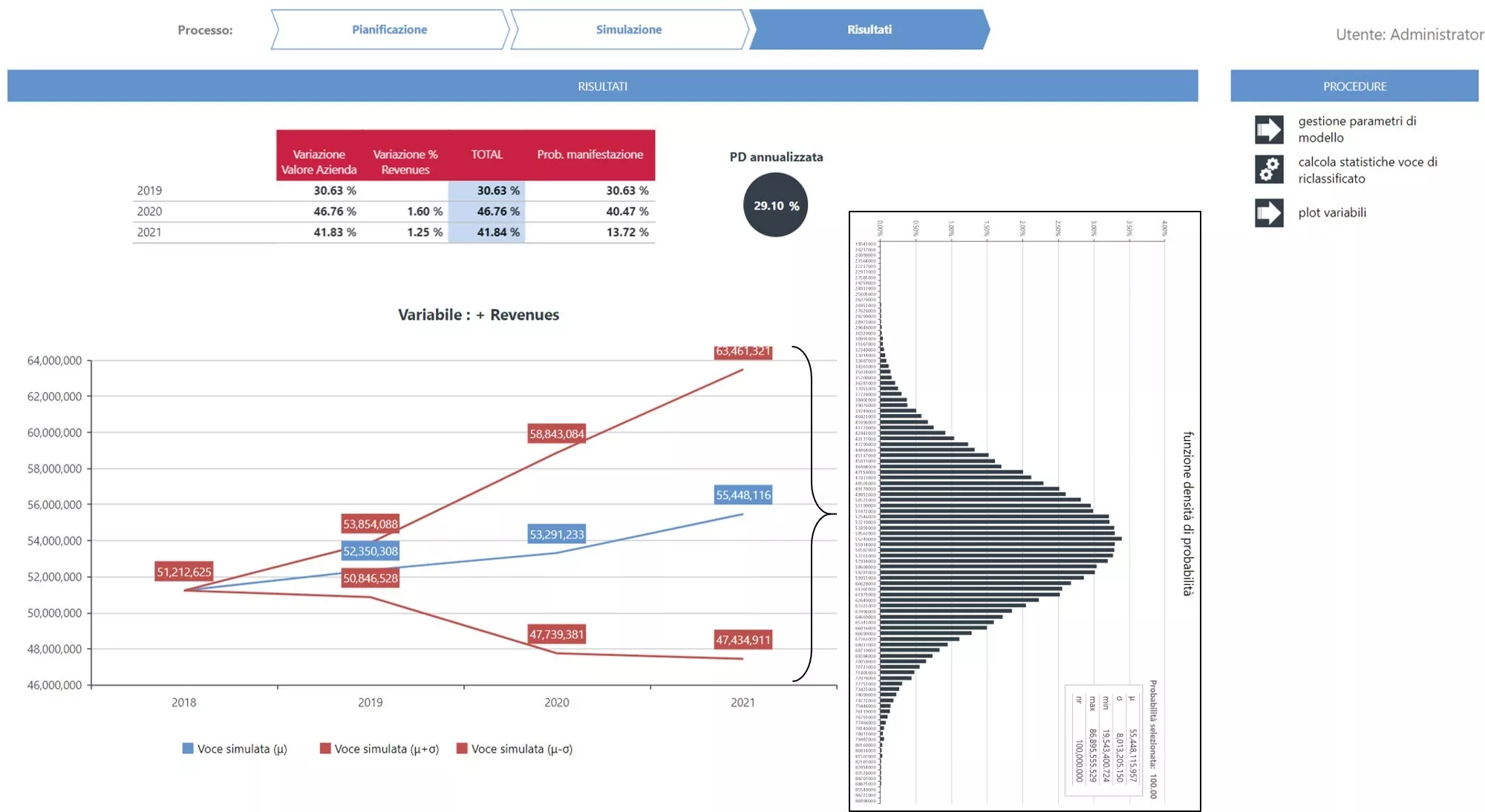

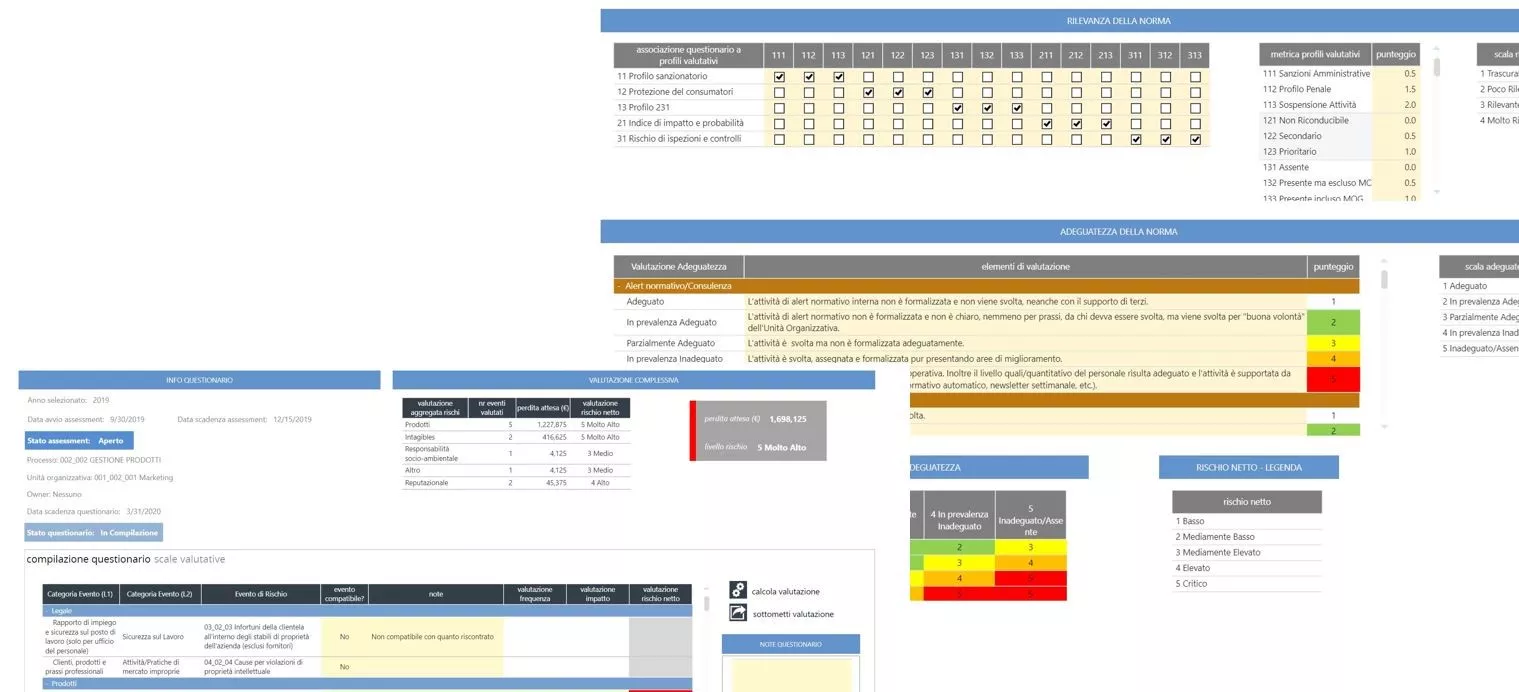

- Risk evaluation, applying both quantitative and qualitative approaches (frequency vs impact hit maps, Montecarlo Simulations for sensitivity analysis, other econometric and statistical measures)

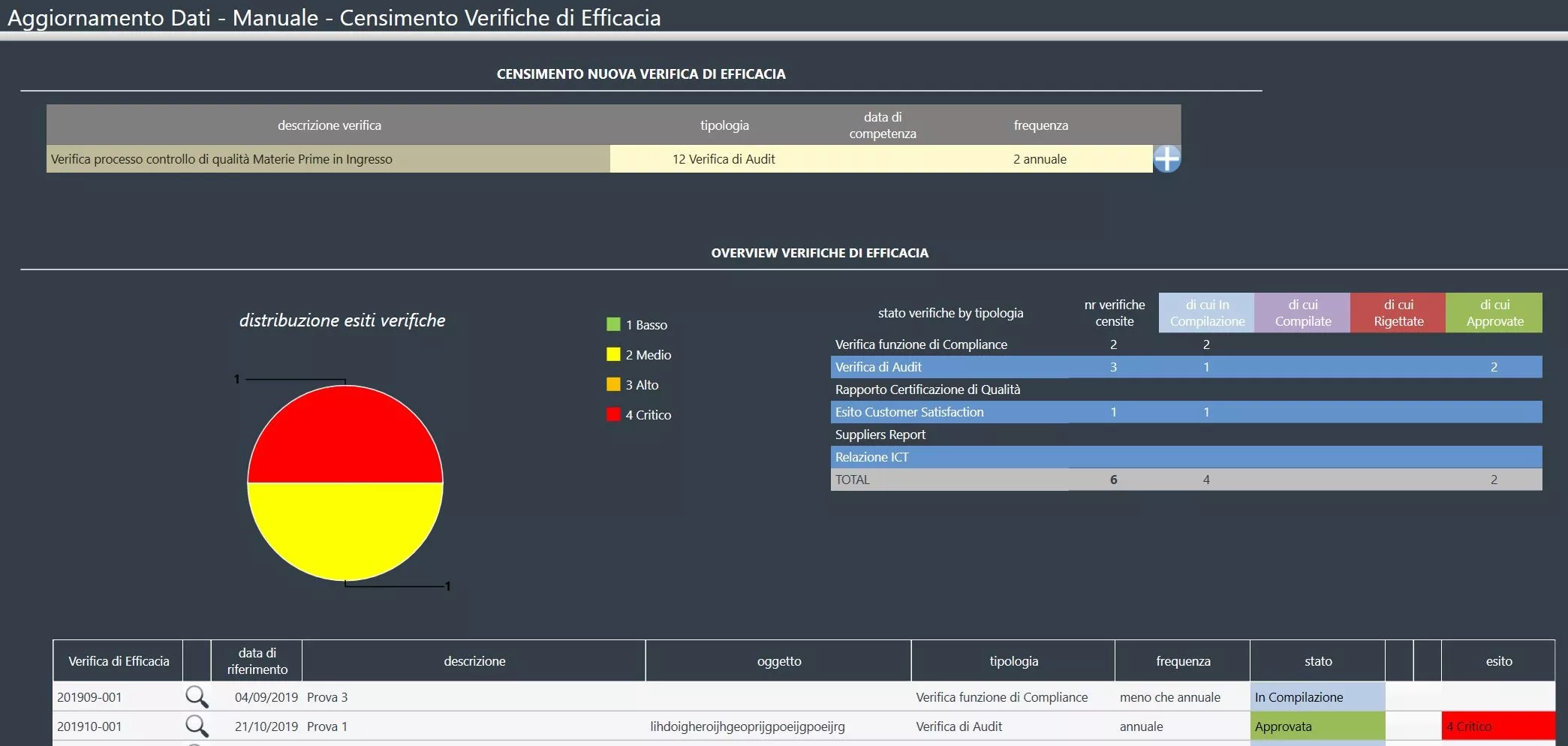

- Risk Monitoring, collecting data from multiple sources and processes, triggering risk alerts, and organizing workflows & activity agendas

- Risk reporting and governance

Why is it necessary to invest in a Risk Management solution?

The risk management perspective is rising in importance for senior management, stakeholders, and regulatory authorities.

Regulatory bodies and authorities are giving unprecedented attention to risk management processes and governance. This will lead to the introduction of increasingly binding new regulations (European Commission Recommendation of 12 March 2014 on a new approach to business failure and insolvency, Italian D.Lgs. n. 14/2019 - Codice della Crisi).

Why Risk Management is only effective in an integrated framework

Risk assessments often require a collaborative process in order to collect opinions from all company stakeholders (specifically for sustainability analysis materiality maps, environmental risk impact analyses, and calculation of the reputational impact of risk events). Quantitative methodologies should not be for high-skilled resources only; local results should be shared and understood throughout the organization in order to achieve an adequate and effective risk culture.

Risk events and risk-sensitive information should be synchronized and distributed throughout the organization. Methodologies, often specialized by risk type and process (Montecarlo Simulation for sensitivity analysis vs. CAPA for qualitative incidents in production process, etc.) should not be confined to the organizational unit that applies the specialized approaches, but should be shared to incorporate and manage the correlation between risks.

To be effective, an integrated risk management framework requires investments in people, methodologies, knowledge, and systems.

Why our solution?

The OIDA Enterprise Risk Management Suite guides the integration process of all existing sub-methodologies, allowing users to customize approaches at the desired level. The solution can effectively help your company structure approaches differentiated by risk, allowing the governance of the risk process by managing:

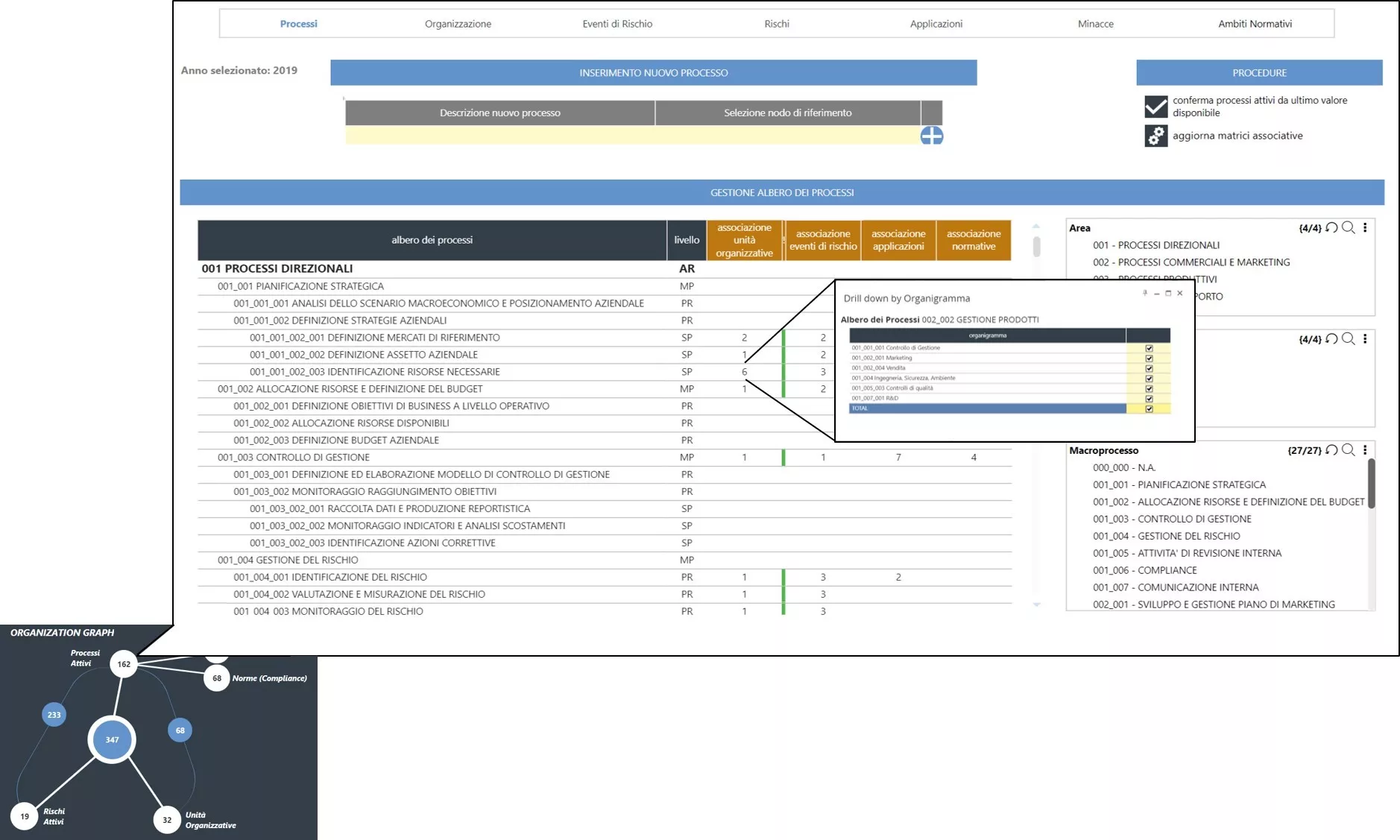

- All the organizational variables in a single place (Organization Units, Process, Applications, IT infrastructure, Risks, Risk Events, Regulations, etc.)

- Risk assessment processes, ruling the actors involved, times and methods of execution, and reporting the execution level of any planned activity

- Risk data collection, supporting day-to-day risk-sensitive events/information acquisition, and managing triggers & escalation processes

- Risk methodology, thresholds, and metrics

- Risk reporting

Risk assessment and monitoring are fully supported by the application, which enables the progress of risk management activities to be followed up. Evaluation results, loss events, and other monitoring events are reported in dashboards for executives.

The application enables parametric management of the whole organizational map, setting relationships between specific dimensions such as Organizational Units, Processes, Applications, Risks, and Theorical Risk Events.

It can be integrated into the application environment and incorporate information from multiple sources. It guides the company to the way in which they are connected by creating summary and analysis views.

The application integrates risk assessment and monitoring models which are implemented with heterogeneous methodologies at increasing levels of complexity.

For certain types of risk, it includes advanced deterministic and econometric models.

Some risks require assessment methods based on a distributed assessment process. To be more effective, the application supports automated operational workflow management and activity progress follow-up.

All the model parameters, such as relationship matrixes, hit maps, and evaluation scales, are available to be managed by authorized users.

The application has been designed to collect and store information from a wide range of sources, including Customer/Supplier satisfaction analyses; supplier audits; internal audits; compliance, incident management, and certification authority reports; and more. All reports are stored and, through a structured process, are given defined triggers to enable the selection of information and reports to share with higher levels of the organization.

For a full understanding of the approach and model of risk governance, the organization of an interactive demonstration of the proposed tool is suggested.